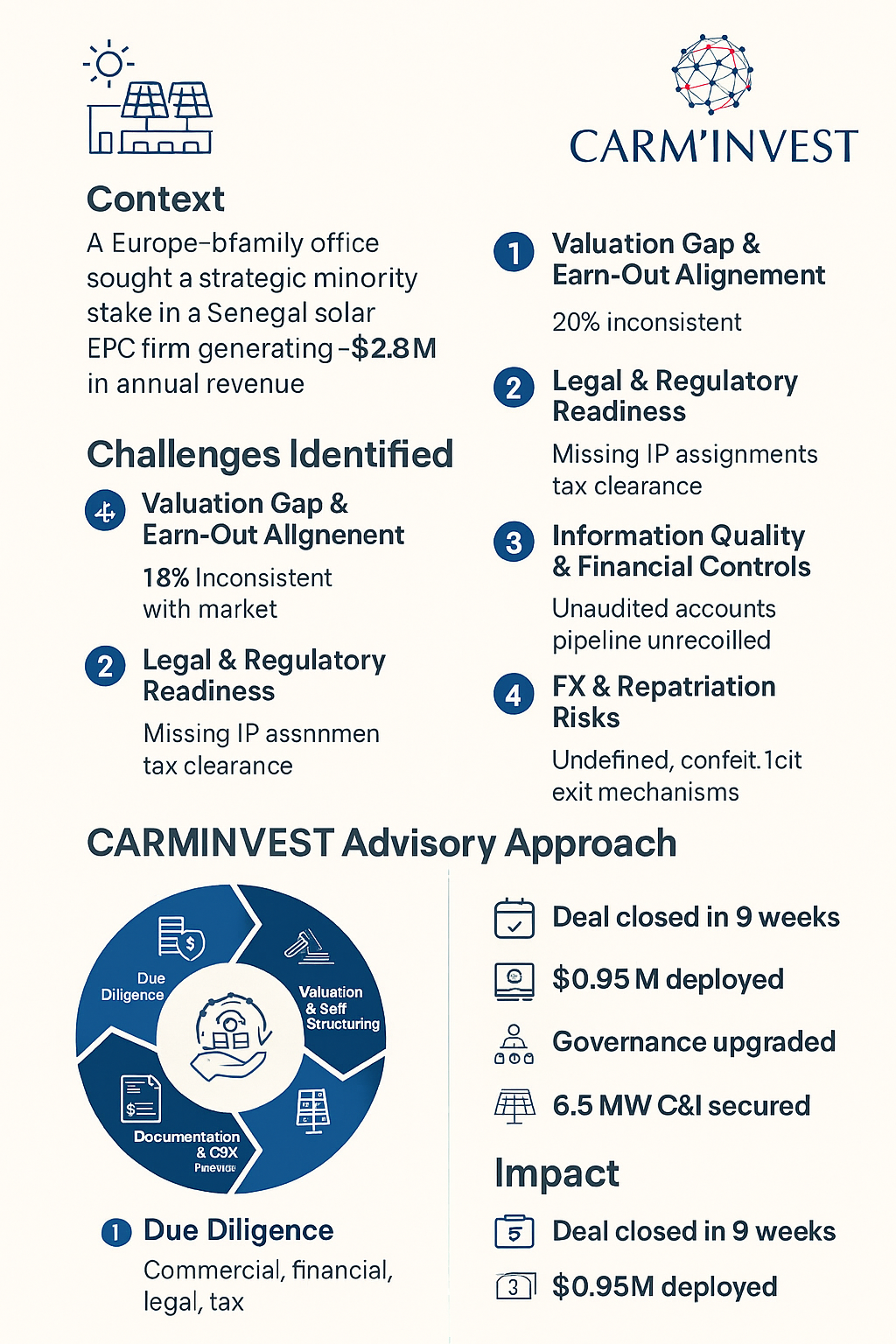

Context

A Europe-based family office sought a strategic minority stake (28%) in a profitable solar EPC SME in Senegal to capture growth in C&I rooftop projects.

The target generated ~$2.8M annual revenue, but lacked robust governance and investment-grade reporting. The buyer engaged CARMINVEST to run end-to-end transaction advisory and close under a $0.95M ticket.

Challenges Identified

1 – Valuation Gap & Earn-Out Alignment

- Seller expectations were 18% above comps; no performance-based mechanism to bridge the gap.

2 – Legal & Regulatory Readiness

- Share registry not up to date; missing IP assignments and outdated tax clearance.

3 – Information Quality & Financial Controls

- Unaudited accounts; project pipeline not reconciled with CRM and contracts.

4 – FX & Repatriation Risks

- Dividend policy, convertibility, and exit mechanics not defined in governance documents.

CARMINVEST Advisory Approach

Step 1 – Buy-Side Due Diligence (Commercial, Financial, Legal, Tax)

- Validated revenue quality (backlog, win-rate, margin by segment) and normalized EBITDA.

- Legal DD on licenses, IP, employment, tax status; red-flag report with remediation plan.

Step 2 – Valuation & Deal Structuring

- Triangulated valuation via DCF, trading comps, and precedent deals; set price collar.

- Structured a two-tranche investment with a 24-month earn-out tied to MW installed & EBITDA.

Step 3 – Documentation & Conditions Precedent

- Negotiated SPA, Shareholders’ Agreement (board rights, reserved matters, dividend policy).

- Set CPs: tax clearance, IP assignment, audited FY accounts, and ESG policy adoption.

- 10% purchase price held in escrow; seller reps & warranties with indemnity cap (20% of price).

Step 4 – Closing Mechanics & Post-Close Value Creation

- FX hedge (NDF) on funding leg; capital injection via compliant cross-border route.

- 100-day plan: CFO-as-a-service, monthly reporting pack, procurement savings, bank line renewal.

Impact

- Deal closed in 9 weeks from LOI; price within the agreed collar.

- $0.95M deployed (80% primary growth capital / 20% secondary to founder liquidity).

- Governance upgraded: independent director, quarterly board, dividend & treasury policy.

- Commercial uplift: win-rate +9 pts; secured 6.5 MW C&I pipeline within 6 months.

- Expected investor return: IRR 18–22% with downside protection via earn-out and indemnities.