Context

A Congolese developer operated a portfolio of 12 solar-hybrid mini-grids (5.4 MWp / 23 MWh batteries) serving secondary towns in Kongo Central and Haut-Katanga.

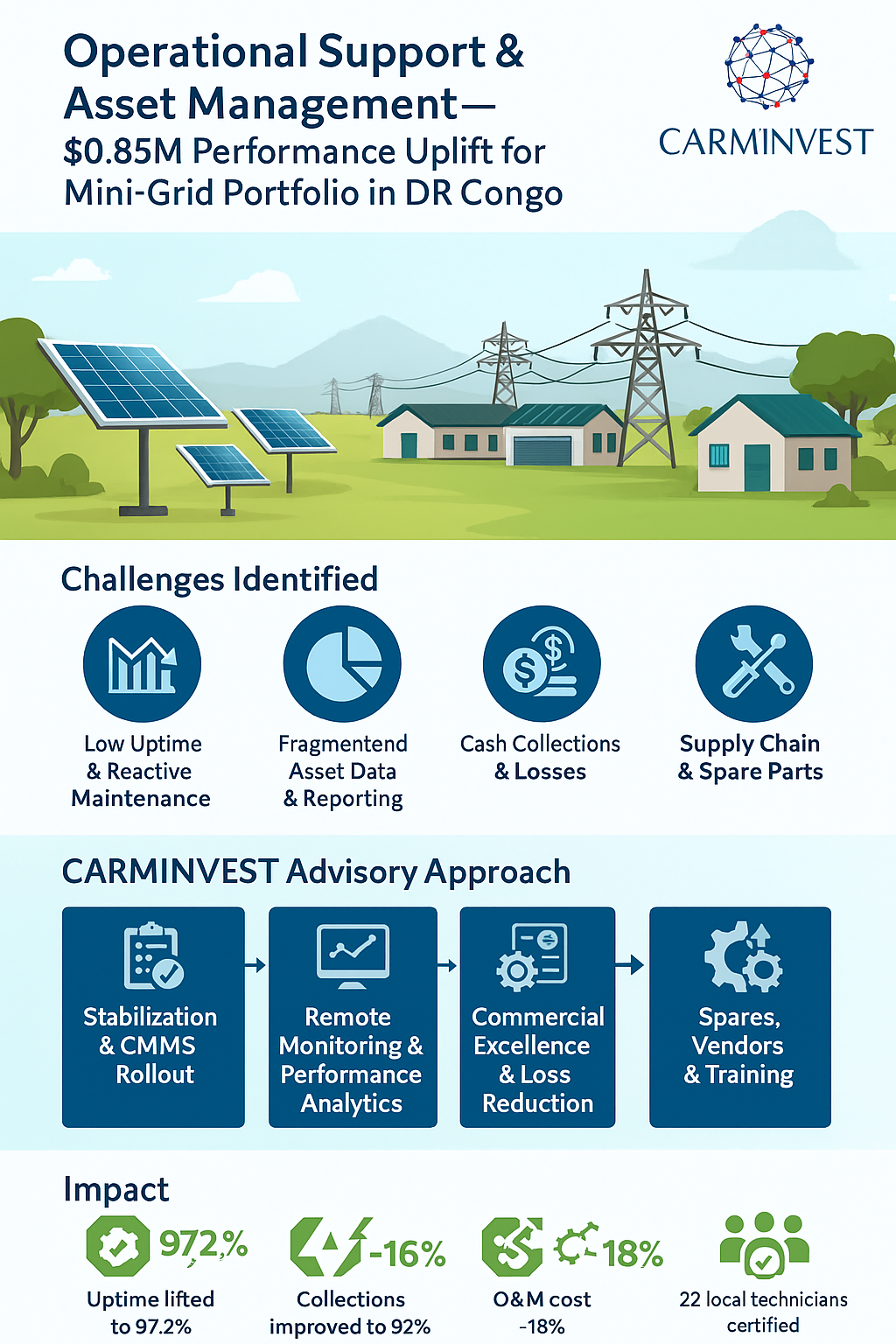

After commissioning, the assets suffered from high downtime, weak collections, and escalating O&M costs due to spare-parts delays and limited field supervision.

CARMINVEST was mandated to implement a $0.85M, 24-month operational support & asset management program to stabilize performance, protect investor returns, and prepare the portfolio for refinancing.

Challenges Identified

1 – Low Uptime & Reactive Maintenance

- Unplanned outages; mean time to repair (MTTR) > 18 hours; no preventive maintenance plan.

2 – Fragmented Asset Data & Reporting

- No unified asset register; SCADA data not reconciled with site logs or financial KPIs.

3 – Cash Collections & Losses

- Collection rate ~72%; technical and commercial losses not traced by feeder/customer segment.

4 – Supply Chain & Spare Parts

- Lead times > 10 weeks; critical spares stock-outs (inverters, controllers, fuses).

CARMINVEST Advisory Approach

Step 1 – Stabilization & CMMS Rollout

- Deployed a Computerized Maintenance Management System (CMMS) with asset register, PM plans, and work orders.

- Standardized SLAs and site checklists; established a 24/7 ticketing & escalation process.

Step 2 – Remote Monitoring & Performance Analytics

- Integrated SCADA/IoT dashboards (inverter, battery, genset telemetry) with alarms for predictive maintenance.

- Created KPI cockpit: uptime, MTTR, specific yield, losses, and site-level P&L.

Step 3 – Commercial Excellence & Loss Reduction

- Introduced smart metering for top-10 load segments; feeder audits to cut technical/commercial losses.

- Re-designed tariff tiers and collection workflow (mobile money, dunning, prepay migration).

Step 4 – Spares, Vendors & Training

- Set critical spares policy (min/max) and framework agreements with two OEMs and a regional distributor.

- Trained 22 local technicians; created a rotating “rapid response” team for priority sites.

Program Envelope & Incentives (within $0.85M)

- Funding mix:

- $480k managed-services retainer (CMMS, NOC, field supervision).

- $210k capex light: meters, sensors, networking, initial spares.

- $160k performance bonus pool tied to uptime & collections milestones.

- KPI-linked incentives: bonus triggers at portfolio uptime ≥ 96% and collections ≥ 90%.

Impact

- Uptime lifted to 97.2% (from 86.5%); MTTR reduced to 6.1 hours.

- Energy yield +13–16% via PM & inverter/battery optimization.

- Collections improved to 92%; commercial losses down by 40%.

- O&M cost -18% through vendor frameworks and critical-spares policy.

- 22 local technicians certified; safety incidents reduced to zero recordables.

- Portfolio prepared for refinancing with lender-grade performance reporting.