1. Context & Challenge

A consortium of local entrepreneurs in Angola identified a strategic opportunity to develop a 22 MW solar power plant to meet the growing energy demand and reduce dependence on fossil fuels. The project had strong environmental and social impact potential, aligning with national renewable energy goals and international sustainability standards.

However, several key challenges blocked the project from moving forward:

- Insufficient equity to reach the required financing threshold.

- Limited access to long-term debt financing from local banks due to perceived project risk.

- Lack of structured financial modeling to attract foreign institutional investors.

- Need for guarantees to secure funding from Development Finance Institutions (DFIs).

2. CARM'INVEST Intervention

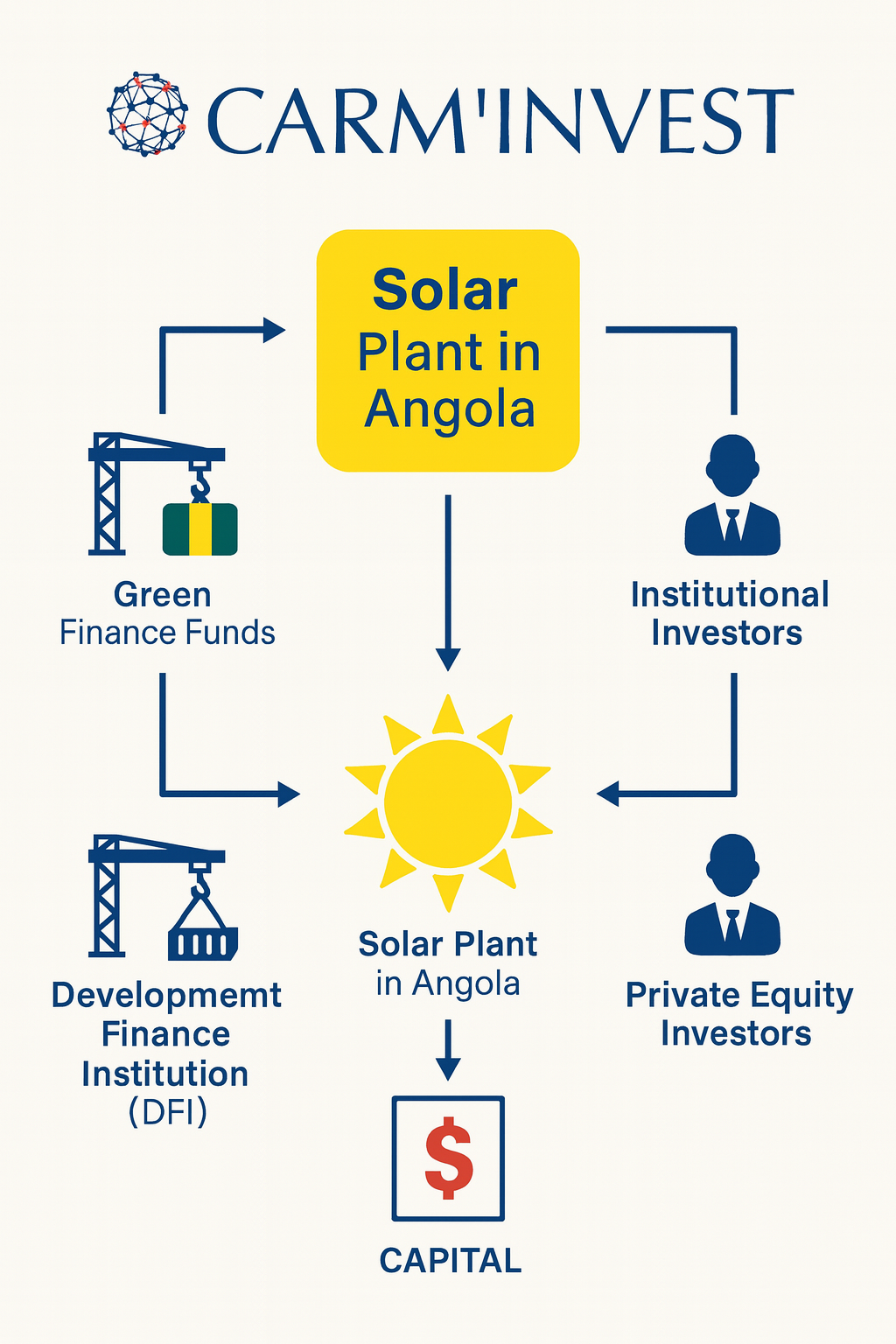

CARM'INVEST was approached to mobilize capital, structure the financing, and position the project for international investment.

Our intervention followed a four-step approach:

Step 1 – Comprehensive Project Assessment

- Technical and commercial due diligence to validate project viability.

- Review of energy demand forecasts, grid integration capacity, and regulatory compliance.

- ESG (Environmental, Social & Governance) compliance audit to meet investor requirements.

Step 2 – Financial Structuring

- Development of a robust financial model with multiple return scenarios (IRR, NPV, payback period).

- Definition of equity–debt structure optimized for risk and return.

- Preparation of an Information Memorandum for investors.

Step 3 – Capital Mobilization

- Identification and engagement of strategic investors in Europe, the Middle East, and North America.

- Negotiation with DFIs and green investment funds for concessional loans and guarantees.

- Structuring of a Public–Private Partnership (PPP) framework to attract sovereign backing.

Step 4 – Risk Mitigation & Closing

- Implementation of currency hedging solutions to protect returns.

- Structuring of political risk insurance through MIGA (World Bank Group).

- Coordination of legal closing and financial disbursement.

3. CARMINVEST Value Added

- $20M capital raised from a diversified pool of investors.

- Project bankability increased through innovative risk mitigation tools.

- Alignment with SDG 7 – Affordable & Clean Energy, ensuring impact beyond financial returns.

- Strengthened investor confidence via transparent reporting and governance mechanisms.

4. Outcome

The project achieved financial close in 18 months and is now under construction. Once operational, it will:

- Power over 40,000 homes in Angola.

- Reduce annual CO₂ emissions by 24,000 tons.

- Create over 1,00 jobs during construction and operation.