Context

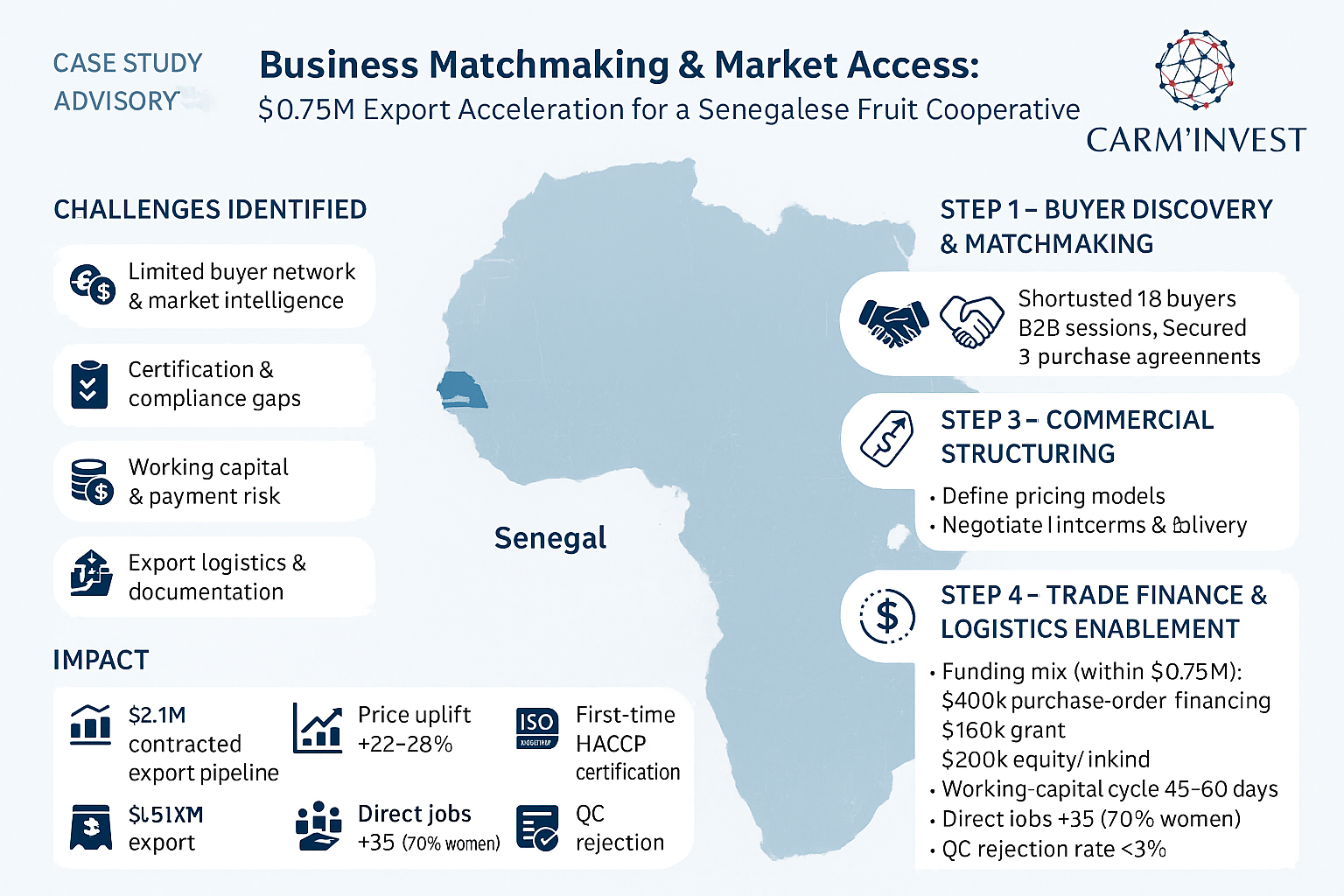

A women-led fruit cooperative in Senegal processes dried mango and pineapple for regional markets.

To unlock premium prices and stable demand, the cooperative aimed to enter EU and GCC retail channels but lacked buyer access, export certifications, and trade finance.

CARMINVEST was engaged to orchestrate business matchmaking, structure the first export program, and secure working-capital support under a total program size of $0.75M.

Challenges Identified

1 – Limited Buyer Network & Market Intelligence

- No direct relationships with EU/GCC importers, distributors, or private-label buyers.

2 – Certification & Compliance Gaps

- HACCP/ISO 22000 not yet audited; lab testing protocols and traceability incomplete for EU entry.

3 – Working Capital & Payment Risk

- Insufficient cash to pre-finance raw material purchases and packaging; exposure to delayed buyer payments.

4 – Export Logistics & Documentation

- Incoterms not defined; lack of clarity on freight options, cold-chain needs, insurance, and customs documentation.

CARMINVEST Advisory Approach

Step 1 – Buyer Discovery & Matchmaking

- Shortlisted 18 qualified buyers (EU specialty importers, GCC distributors, private-label packers) and ran curated B2B sessions.

- Secured 3 Letters of Intent (LOIs) and 2 framework purchase agreements with quality/volume ramps.

Step 2 – Compliance Fast-Track

- Implemented HACCP & ISO 22000 readiness: SOPs, traceability, allergen control, and supplier approval program.

- Set up accredited lab testing (pesticides, moisture, contaminants) and packaging/label compliance for target markets.

Step 3 – Commercial Structuring

- Defined pricing model and escalation clauses; standardized SKUs and specs with AQL acceptance levels.

- Negotiated Incoterms (FCA/DAP), quality arbitration, and performance-based delivery windows.

Step 4 – Trade Finance & Logistics Enablement

- Funding mix (within $0.75M):

- $400k purchase-order financing (revolving line via impact trade financier)

- $150k grant/technical assistance for certification & QA systems

- $200k cooperative equity/in-kind (dryers, facility upgrades, workforce)

- Payment security via confirmed standby LC / escrow; export insurance for credit risk.

- Route design (Dakar Port → EU/GCC) with freight forwarder panel and cargo insurance.

Impact

- $2.1M contracted export pipeline over 18 months (3 buyers, 6 SKUs).

- Price uplift +22–28% vs. regional market through quality and certification.

- First-time HACCP certification and ISO 22000 audit readiness achieved in 5 months.

- Working-capital cycle reduced from 90–120 days to ~45–60 days via PO financing and better payment terms.

- Direct jobs +35 (70% women) and +250 smallholder suppliers integrated with formal offtake.

- QC rejection rate cut from 8–10% to <3% through SOPs and lab testing.